payday loans in Meridian

Posted on 13.02.2020 19:13:34

Looking for the best payday loans in Meridian

Your local payday loans in Meridian

How to Get a Home Mortgage with Bad Credit

"bad credit loan from getcashexpress assisted me spend for my home requirements easily. Looking for cash loan was a problem-free experience as the terms were clear and rates were mentioned in advance. Thank you a lot for the aid. "- ben hubbard., ca -

"lots of thanks to getcashexpress for quickly authorizing my ask for short-term cash loan with low monthly payments. The direct deposit of cash center was actually unbelievable.

Thank you people!".

Thank you people!".

Personal loans for people with bad credit. Loans for people with bad credit are readily available anytime personal loans for people with bad credit (the keyword is bad credit) is a safe method to borrow the cash you require and utilize it for any function. The destination is that the bad credit loans we provide require no security. Similar to a traditional loan, security as substantial as or higher than the concept amount obtained is essential to obtain the "guaranteed loan". Frequently described as a home equity credit line, a collateralized loan is less risk to a lender when home is vowed as security. With foreclosures at an all-time high, and the "credit crunch" effecting the economy, credit is a product and needs to be considered the pulse of the financial body of america. With a bad credit personal loan, no security is required to get the funds you require. Likewise, another emphasize of loans for people with bad credit is the loan is approved with little or no documents. This can be of great benefit to the borrower. Most of the times, upon approval of the loan, the funds can be readily available within the hour and without any real paper work. Not just are bad credit personal loans online hassle-free, anybody might qualify. Aresponsible credit report and a high credit rating is not needed. First amerigo welcomes the chance to attain your financial requirements with our shown ability to keep errors to a minimum and obtain great outcomes. This process for getting bad credit personal loans and unsecured personal loans is handed down to you with self-confidence. Simply by calling, or sending an application, you can gain from the following:.

Loans for people with bad credit range from standard personal, auto, and home mortgage with less-than-favorable terms to short-term, no-credit-check loans like payday and auto title loans. All have benefits and drawbacks, however some are a much better option than others-- and some need to be prevented totally. If you wish to get a bad credit loan, it's important to understand precisely what you require it for so that you do not lose your time taking a look at the incorrect lenders.

While it might not be easy to get a home loan with bad credit (fico ® score under 580), it's possible. Nevertheless, it is necessary to carefully take a look at the terms, rates of interest and possible risks prior to moving on. So-called "bad credit home mortgage" are likewise called subprime loans. Subprime loans featured higher rates and less beneficial terms than basic loans backed by major financiers. In exchange, you might have the ability to receive a brand-new loan where other lenders will not authorize you.

When confronted with a large expenditure like medical bills, charge card debt, or home enhancement costs, lots of americans secure a personal loan as a method to spread out the expenditure into a series of monthly payments rather of a substantial up-front amount. Personal loans are typically unsecured, suggesting you do not need to install any personal security (such as your home or car) versus the loan if you're approved. Personal loans are generally booked for people with good credit scores, however if you have bad credit, we discovered the very best options readily available for borrowing money to cover immediate expenses.

Access to fast loans makes a substantial distinction, specifically when it pertains to college or debt benefit, even home remodel tasks. If you find yourself in requirement of cash for education, small company expenses, or perhaps car repair work, utilize online small personal loans that can undoubtedly act as a means for resolving issues such related to improving your personal financial resources. You can utilize personal loans to function as a bad credit student loan for those without credit report or absence of credit.

It deserves bearing in mind that when you borrow money there is constantly a component of risk included. This is generally the case when buying any financial product. Nevertheless, if you choose to get a guaranteed bad credit loan then the risk is increased due to the fact that whatever property which you are utilizing to secure your loan is at stake. If you are utilizing your home for the security of the bad credit loan then there is a high risk included. If you can not for some reason make the payments on your loan you might possibly lose your home and have it repossessed. In the very same method if you are utilizing your car or jewellery to secure your loan you might lose that if payments are not made. Nevertheless, with a protected loan you will find interest rates can be lower and you can borrow more money.

How Do Credit Cards Work?

Even if your credit is poor, your local credit union might deserve a shot. The majority of cooperative credit union offer small-dollar loans of $500 and above, and they are typically going to deal with you to make the payments budget friendly.

Lots of likewise have starter charge card or loans to assist you build a credit report. The rates of interest charged by a federal cooperative credit union is topped at 18%.

Lots of likewise have starter charge card or loans to assist you build a credit report. The rates of interest charged by a federal cooperative credit union is topped at 18%.

Is your credit report ready to go listed below 650 or perhaps 600? if you are going through a layoff or some other work disturbance or other financial chaos, your car payments are most likely likewise behind, and your charge card are most likely to be at or near the limit. Credit report give banks a method to apply some harmony to their decision-making when it pertains to authorizing or rejecting loan applications. A low credit report means various things, depending upon the person behind ball game. It can suggest a person who presently has actually gone through car foreclosure. He's most likely got maxed-out charge card and is a month or 2 (or more) behind on his payments on those too.

One objective of getting a consolidation loan is to pay off your credit cards to avoid paying high-interest rates. Having good credit will allow you to secure a low-interest rate loan. If you have bad credit, deal with improving it prior to looking for the loan. You might likewise decide to look for a loan from financial organizations that do not focus excessive on credit report however provide low-interest rate loans.

For the majority of people, a bad credit loan is not a great option to settle high-interest charge card as charge card debt generally currently has lower rates of interest. However, in many cases, it may make good sense. If your objective is to combine charge card debt, the very best method to do that is to very first deal with improving your credit report. Then, you can receive either balance transfer credit cards or debt consolidation loans. Getting a debt consolidation loan would permit you to pay off all kinds of debt, not simply charge card.

Are you somebody who has a good credit report however is aiming to reduce your existing amount of charge card debt? the chase slate can be an exceptional option. However, if your credit is still an operate in development, you might not receive this card. If your credit has actually decreased from your debt being expensive, you may get not get approved for this specific chase card. The high credit requirements might lead to you requiring to look for alternative cards with less rigid credentials.

How to Get Your First Charge Card

Prior to making any effort to secure a home mortgage, make certain you end any credit limit that are still active. This might be from your charge card or other loans you have actually taken. The very best option at this moment would be to close any existing charge card and get a much better grip on your financial resources.

"those who understand interest makes it, those who do not, pay it. "(unknown) it would be liberating and profoundly thrilling to be able to cut up and get rid of the charge card, give 2 fingers to the banks and go back to the old ways of operating. Regrettably, the satisfaction would be short lived. We are currently on the insane merry-go-round, and it is near difficult to leave.

Here you'll get cash quickly and you're free to invest it on anything. Banks generally do not permit charge card users to easily invest the cash on whatever they desire. Lots of banks allow their customers to use their charge card online, however in this case, they'll need to deal with a high interest rate.

Pick from our chase charge card to assist you buy what you require. Lots of offer benefits that can be redeemed for cash back, or for benefits at companies like disney, marriott, hyatt, joined or southwest airline companies. We can assist you find the charge card that matches your way of life. Plus, get your free credit report!.

Unsecured loans take place when a financial institution provides you money and does not have a security interest in anything that you own. Charge card are unsecured loans unless you have a card that is protected through your savings account with a credit limit restricted to the funds because account. Personal loans are generally unsecured, and the regards to the loan are figured out by your credit reliability. For instance, if you have bad credit (listed below 550), your rates of interest might be really high.

Your credit report resembles your transcript of financial status, like how you utilize your money and your debt repayment performance history. The credit report is assembled by taking history from various sources, including debt collector, tax payment department, banks, and charge card companies. Similar to you require good marks on school transcript to be qualified for scholarship. Likewise, your credit report need to likewise be good if you wish to get hands on the loan-- bad credit makes it hard.

Initially published on: https://bonsaifinance. Com/5-tips-on-how-to-lower-interest-rates-on-credit-cards-lc/ in 2017, americans with credit cards paid $104 billion in interest and fees. And this number simply keeps climbing. As rates of interest continue to climb up and americans get much deeper and much deeper into debt, exists any method out? among the very best things you can do to get control of your debt is to find out how to decrease rates of interest on charge card. Keep reading for our top 5 tips on how to decrease charge card interest.

10 Reasons Not to Get a Charge Card

© loanatlast - all rights booked

important disclosures

this is an expensive form of borrowing and it is not planned to be a long term financial option. Please note: loan at last loans are designed to help you in fulfilling your short-term borrowing requirements and are not planned to be a long term financial option. Examples of emergency reasons that these loans may be utilized include unanticipated emergencies, car repair work bills, treatment, or necessary travel expenses. Alternative kinds of credit, such as a charge card cash loan, personal loan, home equity credit line, existing savings or borrowing from a friend or relative, might be less costly and preferable for your financial requirements.

Late fees and non-sufficient funds/returned product fees might apply as explained in your loan agreement. Our fees are divulged in your loan agreement. If you do not make a payment on time, we will try to contact you by means of several authorized approaches. We follow the concepts of the federal reasonable debt collection practices act (fdcpa). We might report your payment history to several credit bureaus. If you stop working to repay your loan in accordance with its terms, we might place your loan with or offer your loan to a third-party debt collector or other company that gets and/or gathers overdue consumer debt.

Late fees and non-sufficient funds/returned product fees might apply as explained in your loan agreement. Our fees are divulged in your loan agreement. If you do not make a payment on time, we will try to contact you by means of several authorized approaches. We follow the concepts of the federal reasonable debt collection practices act (fdcpa). We might report your payment history to several credit bureaus. If you stop working to repay your loan in accordance with its terms, we might place your loan with or offer your loan to a third-party debt collector or other company that gets and/or gathers overdue consumer debt.

Have you had trouble protecting a loan from a bank or a cooperative credit union? there might be a chance your credit report is doing you an injustice. In specific, there might be numerous various reasons that your credit is impacting your application. This might include missing out on a lot of bill payments, defaulting on a loan or not staying up to date with your charge card payments.

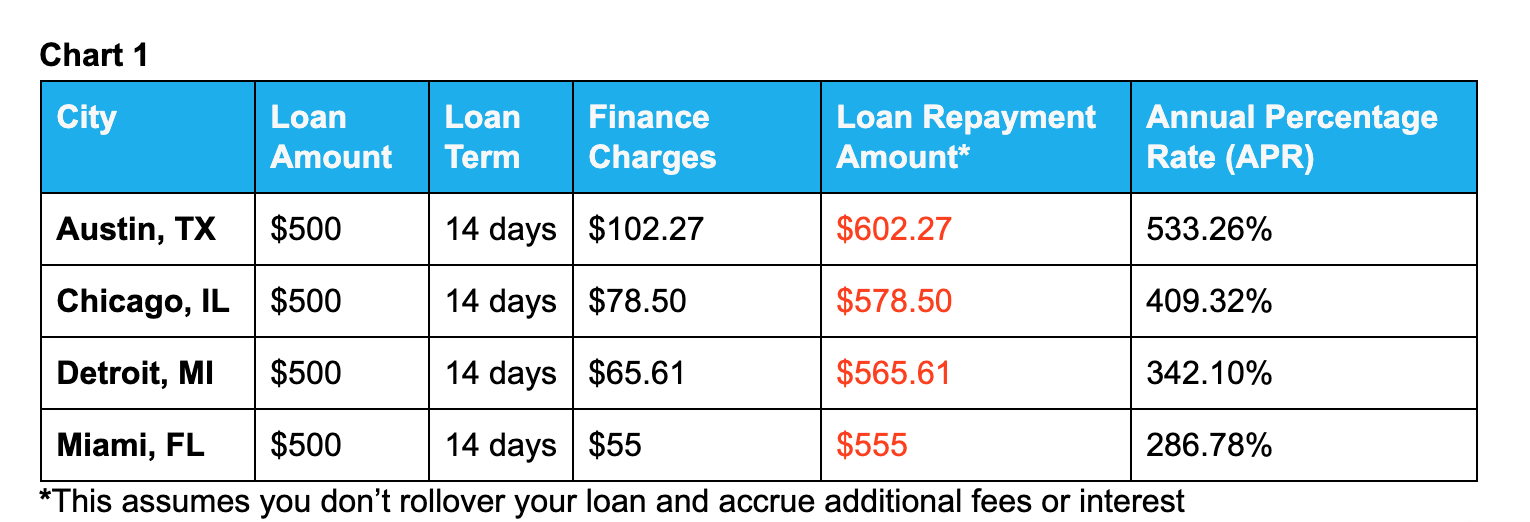

Among the primary reasons not to get a payday loan involves their high rates of interest, which are typically higher than the rates of interest on personal loans and charge card. The majority of payday lenders examine a fee for every single $100 obtained, which can range from $15 - $30. For instance, if somebody secured a $100 payday advance, they would need to repay $115 by their next paycheque. A $15 fee to borrow $100 might resemble 15% interest, however when you do the mathematics, it's in fact comparable to a 390% annual rates of interest, which is more than 10 times the normal rate on a high-interest charge card.

Initially published on https://bonsaifinance. Com/top -5-credit-cards-capital-one-lc/ understanding which capital one charge card is going to be the very best for your requirements is easier stated than done. There are as several kinds of charge card. There' are likewise several reasons to utilize credit. The very best charge card is the one that's going to best fit what you're going to utilize it for. Will your capital one charge card be for personal finance? or will you be utilizing it for business purchases? maybe you will utilize it as a credit line rather of securing another online loan?.

Christmas Loans to Fund Your Holiday Shopping & Vacations

What if you do not have enough funds to cover the shopping expenses? will you look for the holiday loans to fund your holiday shopping and vacations? with the increasing stress of scarcity of funds, availing such loans will be the ideal relocation when it pertains to taking a break.

The loans are easily readily available in a short period of time which is the reason these loan options are getting prominence. In fact, the loans are suggested for your personal requirements and you can utilize them to cover the celebration expenses too. If you have actually settled your dream location you wish to visit this christmas, securing these loans will undoubtedly assist you.

The loans are easily readily available in a short period of time which is the reason these loan options are getting prominence. In fact, the loans are suggested for your personal requirements and you can utilize them to cover the celebration expenses too. If you have actually settled your dream location you wish to visit this christmas, securing these loans will undoubtedly assist you.

However I Believe I Required That Money! (You Do Not)

For all intents and functions, shared funds act as an alternative for financiers who can't afford an separately handled account. Shared funds are formed when financiers with smaller sized quantities of capital, swimming pool their money together and after that work with a portfolio supervisor to run the combined swimming pool's portfolio-- consequently purchasing various stocks, bonds, or other securities in a way constant with the fund's prospectus. Each financier then gets their particular piece of the pie while sharing the expenses, which appear in something called the shared fund expenditure ratio. Shared funds can be structured in numerous various ways, including open-ended shared funds vs. Closed shared funds being one especially important difference.

Our online application is fast to complete and you can receive a decision quickly. If approved, money might be in your account in just one business day.

At 24 cash loans we understand that people require our aid when no other approach of getting instant cash works for them. They require money for emergency requirements and as early as possible. This is the reason that we keep the process of borrowing an instant loan online simple and fast. In fact most of the times the online loan application gets approved within a couple of minutes.

There is no doubt that due to the lack of commitment, the interest rate tends to go higher. For a lender, it is really important to compensate the risk of money provided to the borrowers. In case, when you provide guarantor or security, the lender owns the authority to ask the guarantor to repay the loan or take the property in case of default. However, with absolutely nothing in hand in the name of security and warranty, it ends up being important to think of other ways. With a high interest rate, you pay substantial installations and give more money on every repayment date. Nevertheless, this does not suggest that this makes the loan and rates unaffordable.

Often borrowers are actually puzzled by the fact that a lender might provide a guaranteed bad credit personal loan understanding that they are not solvent. Due to the fact that you have a bad credit fico rating generally means that you have a bad routine of late payments when you have not defaulted. The lender is making a substantial risk by offering you the cash when they lend it to you. However this argument is based simply on your bad credit history. Naturally lenders understand that you are experiencing problems in obiding to your credit commitments in the past and they can't find any prooves that you have actually altered.

It does not take long to get burned-out from composing for zemandi. You compose so hard therefore much and the amount of money you're being paid does not show that. Yes, while $55. 75 looks good in my account, it does not feel good understanding that i might've earned money that amount off of one single post when it took me blogging about 15-20 various posts (every one taking an hour or more to compose) for that small of an amount.

The 12% option: make a 12% average annual return on your money, beating the s & p 500, mad money's jim cramer, and 99% of all shared fund supervisors ... by making 2-4 trades each month

picking in between a fixed-rate and a variable-rate mortgage (arm) is something you can think of smartly prior to meeting a mortgage officer. Picking a negative-amortization rate is constantly an error. The reason is that the balance on your loan continues to build, even when you make the required monthly payments. When you go to offer the home, you might find that the balance you owe is higher than the list prices that you can ask.

this is some words in the Meridian city

Watch this payday loans video in

This is a page on payday loans in Meridian